Unlocking the Power of Customer Lifetime Value (CLV) for Business Growth

Understanding Customer Lifetime Value (CLV) is essential Key Performance Indicator (KPI) for fostering long-term growth. CLV measures the total revenue a company can expect from a customer throughout their entire relationship. This metric is crucial for making informed decisions about customer acquisition, retention, and overall business strategy.

Defining Customer Lifetime Value

Customer Lifetime Value (CLV) quantifies the total revenue a customer generates for a business over their relationship period. It includes all purchases made by the customer, not just the initial transaction. CLV provides insights into the long-term value of customer relationships, helping businesses strategize for enhanced profitability.

The Importance of the Customer Lifetime Value (CLV) in a Business

- Customer Retention Focus: Retaining existing customers is often more cost-effective than acquiring new ones. CLV emphasizes the importance of retention strategies.

- Revenue Forecasting: CLV aids in predicting future revenue, contributing to better financial planning.

- Efficient Marketing: By categorizing customers based on their CLV, businesses can optimize marketing efforts for maximum return.

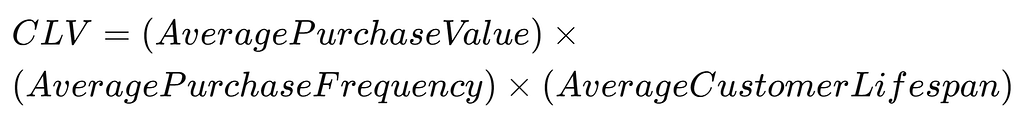

Calculating the Customer Lifetime Value (CLV)

To calculate CLV, follow these steps:

- Determine Average Purchase Value: Divide total revenue by the number of purchases within a specific period.

- Calculate Average Purchase Frequency: Divide the total number of purchases by the number of unique customers.

- Compute Customer Value: Multiply the average purchase value by the average purchase frequency.

- Estimate Average Customer Lifespan: Determine the average duration a customer continues to make purchases.

- Apply CLV Formula: Multiply customer value by the average customer lifespan.

Boosting CLV

- Implement Loyalty Programs: Reward programs incentivize repeat business and increase customer engagement.

- Encourage Cross-Selling and Upselling: Offering related products or premium options can increase the average purchase value.

- Maintain Regular Engagement: Consistent communication through emails, social media, and other channels keeps your brand in customers’ minds.

Practical Example

Take a subscription-based streaming service. By analyzing CLV, the company might find that users who frequently use their recommendations feature have a higher lifetime value. This insight can lead the company to enhance this feature and promote its use, thereby increasing the overall CLV.

Conclusion

Customer Lifetime Value is more than just a KPI, it’s a strategic approach. By focusing on CLV, businesses can build stronger, long-lasting relationships with customers, ensuring sustained growth and profitability. Adopting CLV-centric strategies not only improves financial outcomes but also cultivates a loyal customer base that advocates for your brand.

Incorporating CLV into your business strategy is crucial for understanding your customers’ true value and driving long-term success. This approach enables smarter decision-making, optimized marketing efforts, and ultimately, sustainable business growth.